Now that we have the Royal Commission’s report into the financial services industry, the question of how the sector can regain the trust of its customers has become urgent and nationwide. There is hope … but clearly, a great deal of work needs to be done. What is the nature of this work? In my view, it is serious work on changing the culture of the sector.

Reading the Commissioner’s final report, I have grave concerns for the viability of the banking industry unless there is transformative change and the customer is placed at the centre of all that the industry offers. Why am I so concerned? Because the focus of globally successful organisations such as Google and Amazon has significantly shifted from the “Inside-out” way in which big organisations have viewed the world in the past to an “Outside-in” business model that firmly places the customer at the centre of the organisation. While the banks have taken up the rhetoric of customer-centrality, the Commissioner’s report makes it clear that they have persisted with the old Inside-out approach, which positions the customer at the periphery of an essentially self-serving enterprise.

The Royal Commission’s final report is replete with examples in which the customer has featured only as an afterthought. The sector has rewarded its personnel not for their respectful, empathic and passionate engagement with their customers but for selling products regardless of their customers’ needs and best interests. The lack of customer-centricity in the sector is apparent from the Commissioner’s opening observation on page one of the report:

First, in almost every case, the conduct in issue was driven not only by the relevant entity’s pursuit of profit but also by individuals’ pursuit of gain, whether in the form of remuneration for the individual or profit for the individual’s business. Providing a service to customers was relegated to second place. Sales became all important. Those who dealt with customers became sellers. And the confusion of roles extended well beyond front line service staff. Advisers became sellers and sellers became advisers.

Contrast this with an opening paragraph in one of Jeff Bezos’ letters to Amazon shareholders:

One advantage – perhaps a somewhat subtle one – of a customer-driven focus is that it aids a certain type of proactivity. When we’re at our best, we don’t wait for external pressures. We are internally driven to improve our services, adding benefits and features, before we have to. We lower prices and increase value for customers before we have to. We invent before we have to. These investments are motivated by customer focus rather than by reaction to competition. We think this approach earns more trust with customers and drives rapid improvements in customer experience – importantly – even in those areas where we are already the leader.

Or take the section on Page 2 of the Commissioner’s report (we have another 496 pages in the same vein in just part One!):

The evidence given to the Commission showed how those who were acting for a client too often resolved conflicts between duty to the client, and the interests of the entity, adviser or intermediary, in favour of the interests of the entity, adviser or intermediary and against the interests of the client

And once again contrast this with the attitude revealed in Bezos’ shareholder letters:

These innovative, large-scale platforms are not zero-sum – they create win-win situations and create significant value for developers, entrepreneurs, customers, authors, and readers.

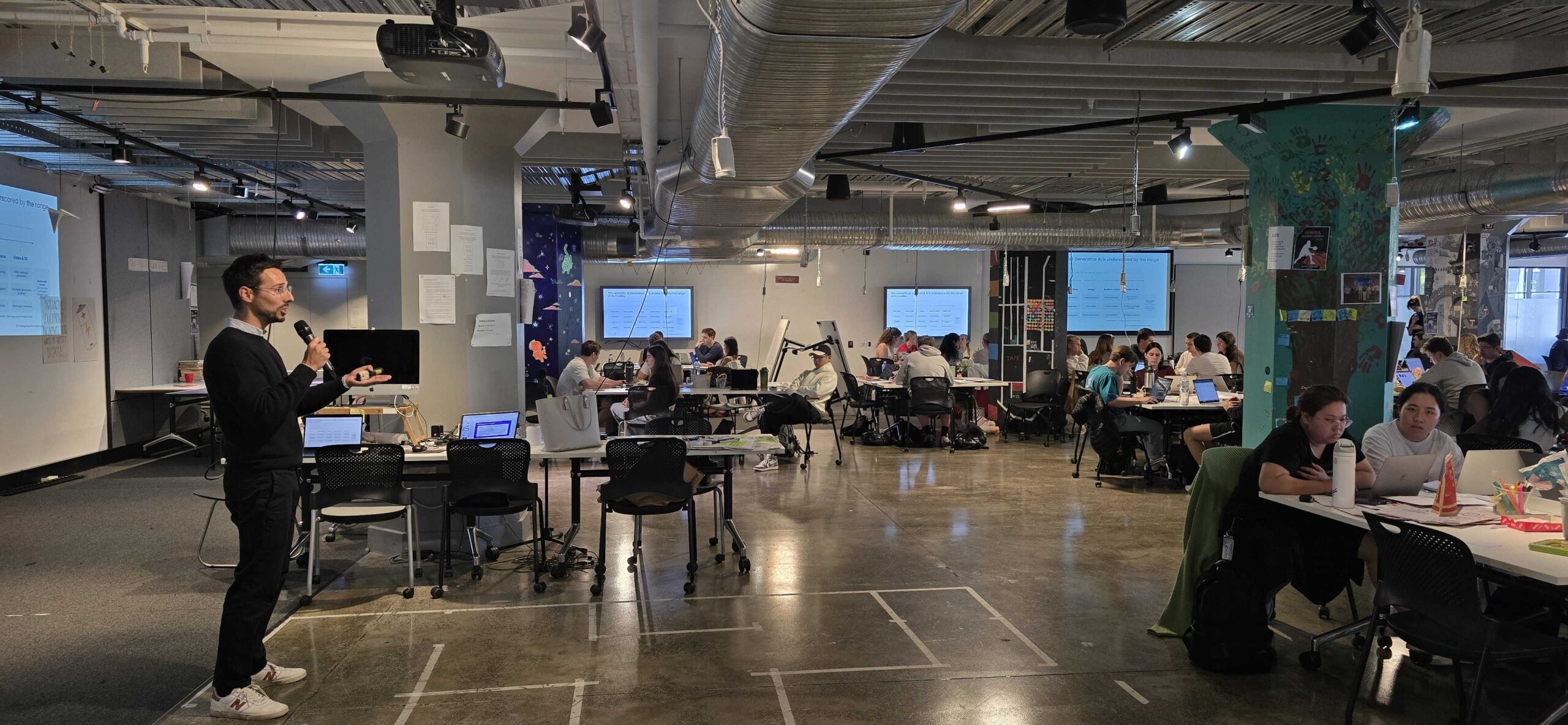

So what are the banks meant to do? Here is our formula for transformation:

a) Recognise that change is urgently needed from the top and all through the executive structure. There is a burning platform and this must be acknowledged.

b) Design a long-term business model for the organisation. Not for one or five, but for twenty years. What will the business look like in twenty years’ time (in terms of its customers, value proposition, partners, revenue, costs, resources) and how can the business transition from where it is now to that model?

c) Put the customer in the centre. Identify each customer segment that the bank services and, through qualitative research, identify their jobs-to-be-done, pains and gains. Now, as challenging as this may be, build a new value proposition for each of these segments consisting of relevant and meaningful products and services, gain creators and pain relievers.

d) Get board and senior leadership buy-in. This must be genuine and evident in action not just in rhetoric.

e) Remove the nay-sayers. There is no time left for these any more. Get out of the road if you can’t lend a hand.

f) Institutionalise the change, generating quick wins, celebrating successes and building on them. Institutionalising change is particularly important – the culture of the entire organisation must shift to make customer-centricity the modus operandi.

The Royal Commission has made an important contribution by revealing systemic abuse of customers in the financial services sector. The remedy the Commission prescribes is an increased focus on regulation and compliance. The risk of viewing the Commission’s findings purely in these terms is that the sector being admonished is likely to focus its energy on appearing to satisfy the letter of the law – the Commissioner’s compliance and regulation requirements – while continuing to ignore the customers themselves.

The remedy we prescribe is business transformation through customer-centricity which is the spirit at the heart of good business. The organisations that embrace this cultural shift will serve their customers with respect, empathy and passion, and it is only those organisations that will be able to flourish in the long term in a globalised world.