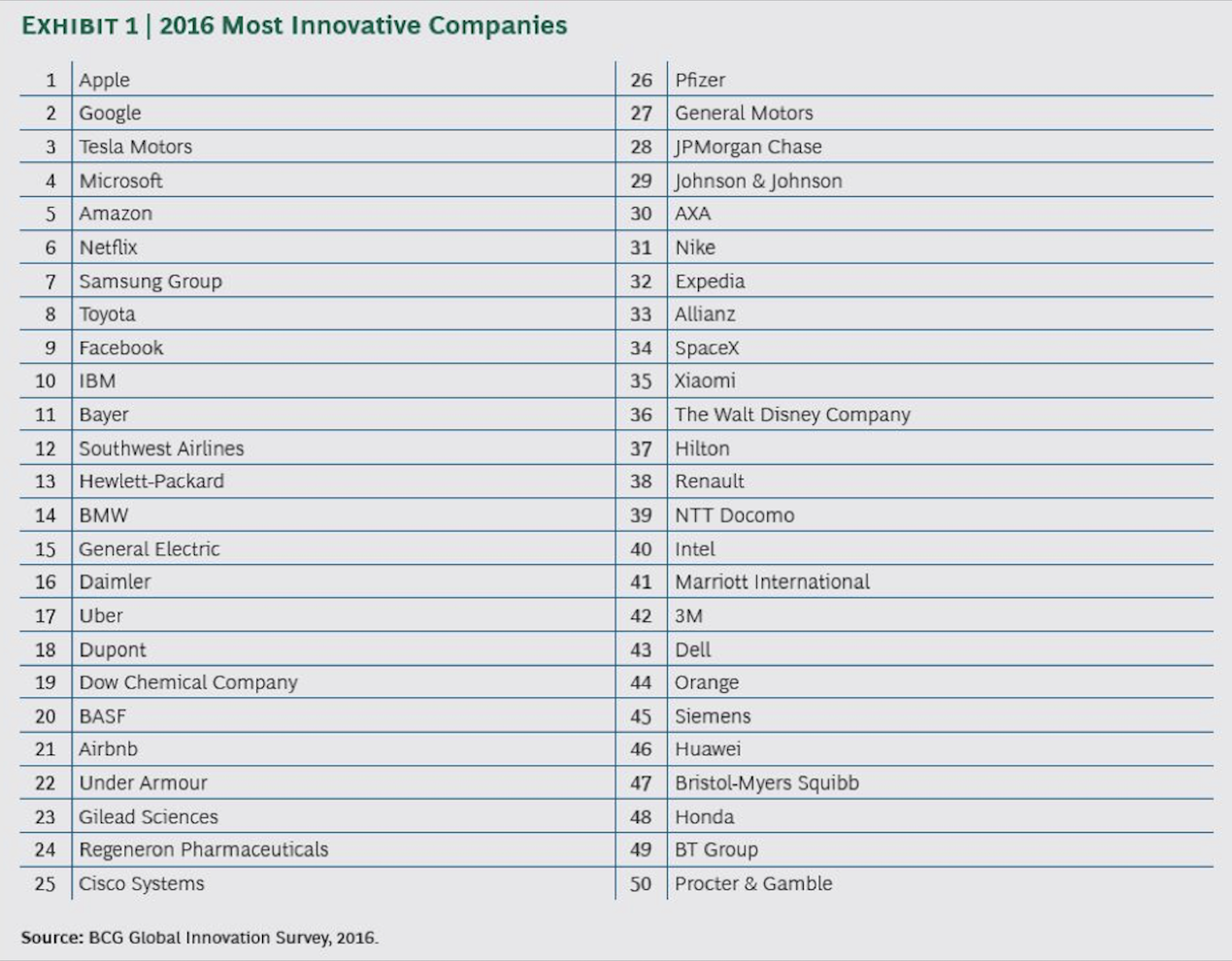

The Boston Consulting Group (BCG) has just released their list of the 2016 most innovative companies globally.

What do the most Innovative Companies have in common?

In addition to leaning towards large established companies with R&D dollars in their list, BCG also focus on how to bring ideas into an organisation from the outside. At The Strategy Group we have been advocating this for some time – not all the smart people in the world work for your organisation. The BCG report highlights three ways in which companies are executing on this process:

- Corporate Venture Capital (CVC). Among the 30 largest companies in BCG’s seven sample industries, the use of CVC increased from 27% in 2010 to 40% in 2015. Among the top ten companies in each sector, it has jumped from 41% to 57%. Companies use venture investments to gain minority positions in startups and an early understanding of new markets, trends, and technologies. Some companies pursue CVC primarily for financial gain, but for many, the investments are strategically focused on furthering innovation. Companies pursuing CVC are split between those that control their investments from the center and those that empower business units to direct them.In the past three years, both strategically and financially oriented CVC units have focused on the software industry, reflecting the increasing value of data as the trends toward digitization and virtualization gather speed, furthering the transformation of hardware to software. The value of CVC investments in software by the top 30 companies now surpasses the value of their investments in all other target industries combined.

- Accelerators and Incubators. The use of accelerators and incubators has increased from 2% to 44% among the 30 largest companies in the seven industries and from 4% to 66% among the ten largest. Successful accelerators and incubators typically do not operate in a vacuum; they form partnerships with venturing operations from other corporations or team up with independent accelerators or incubators. The partners often have a common interest in specific fields. Accelerators and incubators typically focus on early stages of the innovation process.

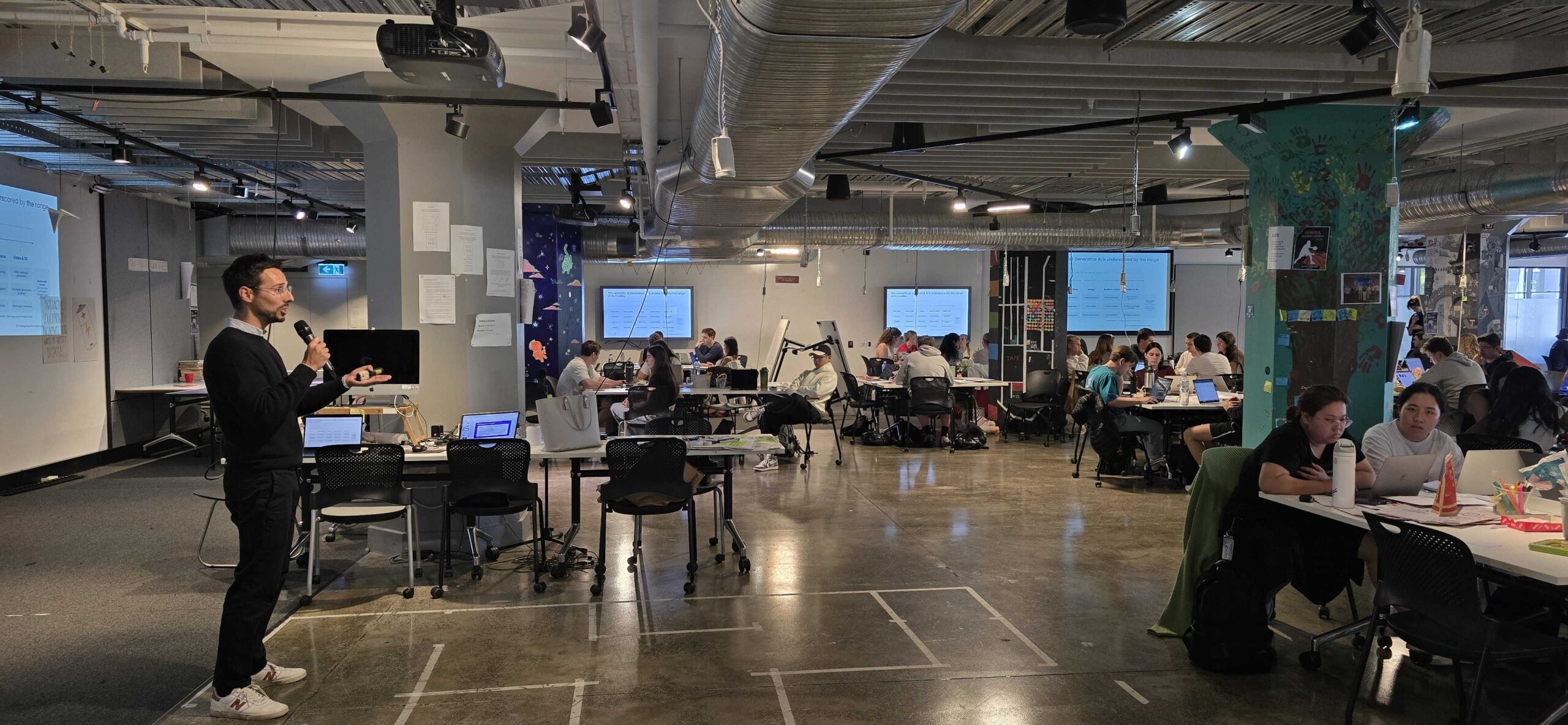

- Innovation Labs. The use of innovation labs has increased from 5% to 19% among the top 30 companies and from 16% to 41% among the top ten. Corporations tend to employ these labs further along the development chain to accelerate time to market. They are in-house units designed to complement—not supplant—conventional R&D and often interact closely with external entrepreneurs. In effect, such labs try to operate as startups, with all the speed and agility that characterize the breed. The main focus of innovation labs tends to be on advancing products or services that are close or adjacent to the core business.

We have expertise and advise organisations in the establishment of all three of these strategies. While we endorse this mode of thinking, we also believe that building innovation capability in the core, in parallel with these three initiatives, is the right way to achieve lasting transformation.

Whilst not wishing to question BCG’s methodology, a few points are worth raising in our view:

- The group judges a company’s level of innovation via a survey of senior executives across multiple industries worldwide, who are asked to rank the most innovative companies both in and outside of their industries. It is fine to be ranked by peers and senior executives, but how much of the ranking will be affected by marketing spin and perception generation?

- The consultancy firm also analyses three key financial metrics: total shareholder return, revenue, and margin growth. While these measures are acceptable, we would hypothesise that it is time for more specific metrics to be set around innovation. These three financial metrics are very basic and in our view do not measure innovation capability.

- Apple is listed as the world’s most innovative company. Do you agree? We certainly would if Steve Jobs was alive, but unfortunately he isn’t. Innovation intensity once again depends on the sorts of metrics used to define it. We understand Apple’s investment in R&D is huge (Their Financial Statement showed they invested $10 million into R&D for the fiscal year that ended Sept. 24, 2016). But is investment in R&D sufficient to gain the top spot?

- Microsoft is number four. We fully appreciate the impact that Microsoft has made to the technology landscape over the past thirty years, but we fail to see how Microsoft today is the fourth most innovative company in the world.

- Nearly 70% of the companies listed are American. We find it difficult to believe that 70% of the world’s innovation comes out of North America alone.

- We believe that what is more important than a lagging indicator of perception and financial reporting are leading indicators of the innovation capability of an organisation to become innovative in the future. An Innovation Index has been deployed successfully in the Not-for-Profit sector – we are keen to see it deployed industries in general. While innovation is certainly about past successes, it also about the internal capability of the organisation to innovate into the future.

Read the entire BCG report The Most Innovative Companies 2016.